Content

The notes are used to make important disclosures that explain the assumptions used to prepare the financial statements of a company. If financial statements are issued strictly for internal use, there are no guidelines, other than common usage, for how the statements are to be presented. If so, the controller generally uses a format that approximates the layout used for external reporting, though it may contain some additional detail that would be considered excessive by outsiders. The additional level of detail is used by managers to monitor the business. If a business plans to issue financial statements to outside users , the financial statements should be formatted in accordance with one of the major accounting frameworks. These frameworks allow for some leeway in how financial statements can be structured, so statements issued by different firms even in the same industry are likely to have somewhat different appearances.

The first section in the financial statement notes explains the basis of preparing and presenting the key financial statements. The notes may also provide information on underlying issues relating to the overall financial health of the company.

Accounting Definition of Uncertainty

Financial statements are a collection of summary-level reports about an organization’s financial results, financial position, and cash flows. They include the income statement, balance sheet, and statement of cash flows. The accounting policies adopted by an entity can affect significantly the presentation of its financial position, cash flows, and results of operations. Accordingly, the usefulness of financial statements for purposes of making economic decisions about the entity depends significantly upon the user’s understanding of the accounting policies followed by the entity.

Skillsoft : Ryzac, Inc. unaudited condensed financial statements as of and for the quarterly period ended March 31, 2022 — Form 8-K — Marketscreener.com

Skillsoft : Ryzac, Inc. unaudited condensed financial statements as of and for the quarterly period ended March 31, 2022 — Form 8-K.

Posted: Fri, 02 Dec 2022 11:14:23 GMT [source]

It is up to the auditor to provide a legal statement of validity for financial statements. One resource the auditor will use are the notes to the financial statements. For this reason, the information in the footnotes is just as important as the information contained within the statements, particularly from a regulatory perspective. If the financial statements are error free, but there are errors within the notes, the auditor should issue negative remarks. Notes to the financial statements are required by the Financial Accounting Standards Board. Notes are used to disclose important information that explains how accountants applied GAAP in their financial reporting of the company.

Financial reporting in uncertain times

Reported assets, liabilities, equity, income and expenses are directly related to an organization’s financial position. Information on any subsequent events can be found also in the financial statement notes section. Subsequent events refer to events that occur after the balance sheet date but before the release of the financial statements.

Are notes to the financial statements required?

The notes to the financial statements are a required, integral part of a company's external financial statements. They are required since not all relevant financial information can be communicated through the amounts shown (or not shown) on the face of the financial statements.

A possible concern is that they can be fraudulently manipulated, leading investors to believe that the issuing entity has produced better results than was really the case. Such manipulation can also lead a lender to issue debt to a business that cannot realistically repay it. Another concern is that financial statements are entirely historical in nature, and so can be misleading when used to project the future results of a business. For example, a business that relies on government contracts might report robust results for its most https://www.bookstime.com/ recent period, and yet have no additional sales on tap, since it just completed all of the contracts that it had been awarded. Certain prior year amounts in the accompanying consolidated financial statements and related notes have been reclassified to conform to the 1998 presentation. All significant intercompany accounts and transactions have been eliminated. Registrants should provide disclosures required under paragraph in filings with the Commission that include financial statements of fiscal periods ending after June 15, 1997.

Inclusion in annual reports

Supplements to illustrative disclosures, which illustrate additional disclosures that companies may need to provide on accounting issues. To use as the basis for an annual report, which is distributed to a company’s investors and the investment community. To investigate the details of certain business transactions, as outlined in the disclosures that accompany the statements. If the revenue of the business is more than expenses, it results in profit for the business. Similarly, if the expenses are more than the revenue, it results in a loss for the business. If assets of the business are more than liabilities, equity is positive. On the other hand, if liabilities are more than assets, the equity is negative.

- The footnotes present required disclosures, accounting methodologies used, any modifications to methodologies from previous reporting periods, and upcoming transactions that may affect future profitability.

- Financial statements that are being issued to outside parties may be audited to verify their accuracy and fairness of presentation.

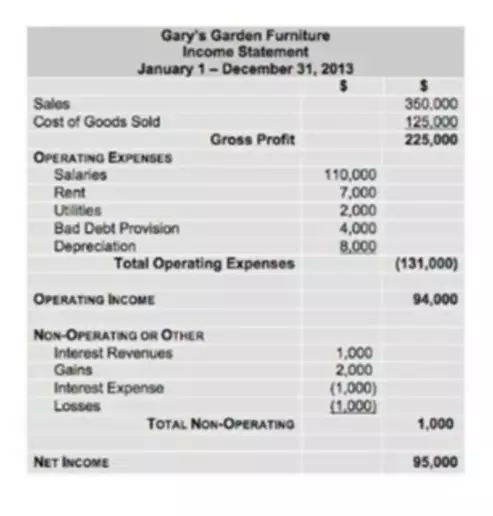

- The main components of the income statement include revenue, expenditure, and profit & loss.

- Leasehold improvements are amortized over the lease term using the straight-line method.

- Then, total expenses are subtracted from total revenues to determine the net income or loss.

- The “net” revenues, or the amount of money remaining after the deductions, will be stated.

The fixed-price options to increase the equity interest in CS-Interglas are significantly higher than their fair market value and expire on December 31, 1999. The unconsolidated net sales in 1998 for these joint ventures were in excess of $300,000.

The accompanying consolidated financial statements and related notes reflect estimates and assumptions made by the management of Hexcel. These estimates and assumptions affect the reported amounts of assets and liabilities, the disclosures with respect to contingent assets and liabilities, and the reported amounts of revenues and expenses. During notes to financial statements 1999, the Company completed two transactions in which it acquired the assets of the related businesses. The transactions were accounted for as purchases, in which the combined purchase price of $11,642,000 was allocated based on the fair values of assets acquired, with the excess amount allocated to goodwill, which totaled $6,607,000.

Certain sales and administrative offices, data processing equipment, and manufacturing facilities are leased under operating leases. Rental expense under operating leases was $4,656 in 1998, $4,559 in 1997 and $4,623 in 1996. On January 21, 1999, the company issued $240,000 of 9.75% Senior Subordinated Notes, due 2009. Net proceeds of approximately $231,000 from this offering were used to repay amounts owed under the Senior Credit Facility.

The Difference Between IFRS and GAAP Balance Sheet Footnote Requirements

Hexcel also consented to an assignment by Ciba of Ciba’s rights and obligations under the Strategic Alliance Agreement to Ciba Speciality Chemical Holdings Inc. and Ciba Specialty Chemicals Corporation (collectively “CSC”). In connection with the assignment of these rights and obligations, the Ciba Senior Subordinated Notes that were previously payable to Ciba are now payable to CSC. Stock options are granted under various stock compensation programs to employees and independent directors . The Company accounts for stock option grants in accordance with Accounting Principles Board Opinion No. 25, «Accounting for Stock Issued to Employees» («APB 25»). The Company considers all highly liquid investments with a maturity of three months or less when purchased to be cash equivalents.

What are the major advantages of notes to the financial statements?

The notes can reveal important information on related party transactions, including outstanding balances and commitments. This information can help you identify certain transactions for further assessment, commentary, or consideration.